All You Need to Know About ECL Calculation Under IFRS

Developing and maintaining ECL (expected credit losses) calculation models is a challenge faced by most firms, particularly in these unpredictable economic times when obtaining trustworthy information can be difficult. Expected credit losses must be calculated, recorded, and disclosed correctly in order to comply with IFRS 9. In this section, we go over the effects of the ECL computation under IFRS 9.

What does ECL under IFRS 9 mean and how does it differ from IAS 39’s impairment provision requirements?

Because it is based on the projected expectation of an economic loss of the asset under consideration, the impairment provision under IFRS 9 is also known as expected credit loss (ECL). Previously, a strategy based on losses previously incurred during the reporting period was implied by the impairment provisioning requirements of IAS 39. Furthermore, in accordance with the prior accounting standards, provisions were only made in cases where there was proof of impairment as of the reporting date. The obligation for making provision based on the assumption of credit losses even at the first recognition of assets is outlined in IFRS 9, which offers a forward-looking approach.

Principal components that are involved in calculating ECL

The primary variables in the ECL computation are

• Exposure at Default (EAD): EAD is the estimated credit risk exposure for each asset for which ECL is computed at any given moment. For instance, EAD for an investment will be its amortized cost balance according to the business’s books on the reporting date if we are evaluating ECL for a specific company on any of its bond investments.

• Probability of Default (PD): This indicates the estimated likelihood that any asset will experience a default.

• Loss Given Default (LGD): This stands for the estimated financial loss to the business in the event that any asset experiences default. When calculating this ratio for any asset, the presence and value of collateral are crucial factors to consider.

• ECL formula: ECL = EAD x PD x LGD is the fundamental ECL formula for any asset. This needs to be further improved in light of each company’s unique requirements, the strategy used for each asset, sensitivity considerations, and discounting factors depending on the expected life of assets as needed.

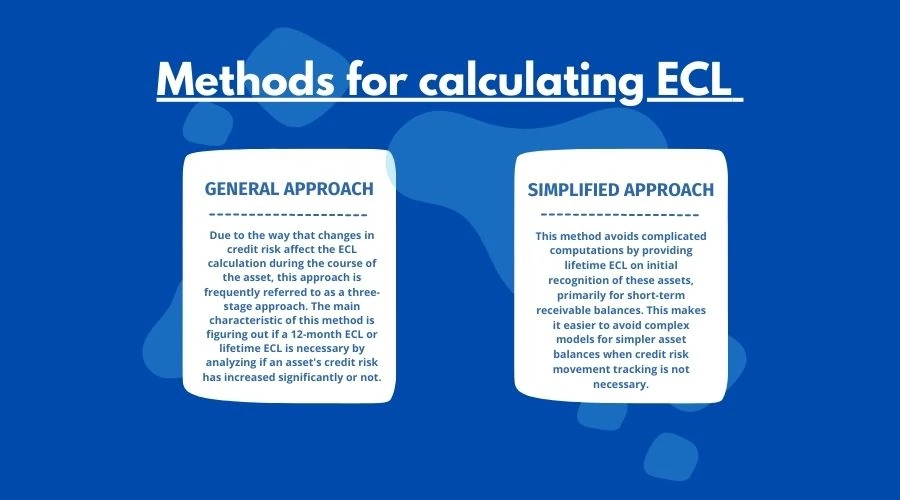

Under IFRS 9, various methods for calculating ECL are permitted.

How can I determine if an asset's credit risk has significantly increased for the purposes of calculating ECL?

The following information about the asset or receivable account that is being considered for ECL needs to be examined in order to assess whether or not there has been a noticeable rise in credit risk:

• Any changes in the price of debt or equity in relation to outside market indications

• Any unfavorable alterations to the operational or financial circumstances

• Any modifications to internal value indicators, such as a decline in credit rating

• Variations in the repayment schedule or fluctuations in the market value of the collateral held

• Significant drop in the operational performance

• Payment defaults

What difficulties arise when a model for ECL calculation is updated?

Among the main obstacles the businesses faced when changing their ECL calculation models were:

• The availability of trustworthy external data to be used in the ECL calculation model, such as company ratings, macroeconomic variables, discount rates, etc.

• Availability of internal historical data in the needed detailed level to establish the trends and to personalize the calculations

• Including industry- and company-specific information in the ECL model

• The models and assumptions used in the calculations are documented, allowing data to be updated in the model as needed.

• Including the modifications into an already-existing ECL model for any significant shifts in the company’s operations or the state of the economy in which it operates.

How can IBR GROUP assist your business with the implementation and evaluation of ECL calculation models?

With a trained staff in IFRS accounting and a wealth of experience working with several clients, IBR GROUP offers a range of consulting and advising services, including:

• To address any questions you may have about the IFRS 9 standards and the ECL computations.

• To create ECL calculation models that are appropriate for your company’s assets.

• To help with recording the justification for methods used and different underlying presumptions

• To examine the company’s current ECL models to confirm their completeness and compliance with IFRS 9 standards.

• To assist you in integrating the ECL models with ERP systems to provide optimal computation automation

I hope you now understand the significance of the ECL computation under IFRS 9. Do you have any questions about IFRS 9’s ECL calculation? Please don’t hesitate to get in touch with us for a free one-hour consultation during which we can go over the most recent updates and revisions regarding IFRS regulations as well as industry best practices.